ADX Energy Ltd.: Upper Austrian License expansion targets a World Class Gas Prospect and Renewable Energy Projects in the heart of Europe

A significant expansion to ADX’ existing portfolio, including a world class gas prospect

Wien (pta015/16.05.2022/09:16 UTC+2)

"A significant expansion to ADX' existing portfolio, including a world class gas prospect with the potential to significantly contribute to Austrian and European gas supply security as well as green energy transition projects"

Key points:

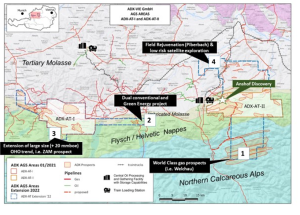

- ADX has finalised agreements with the Austrian Mining Authority for the expansion of ADX's current 450 km2 license area for exploration, production and gas storage to an area of 1022 km2.

- A potentially transformational portfolio of new opportunities targeting large gas resources in response to Europe's energy supply crisis as well as established geothermal potential required for the ongoing transition to renewable energy.

- The portfolio expansion includes the following evaluated projects which can be "drill ready" in a short timeframe;

- ADX is very well placed with its expanded Austrian portfolio to commercialise oil, gas and renewable opportunities required to satisfy unmet European demand for oil and gas in the near- term. ADX is seeking to benefit from very high energy prices as well as the renewable energy transition in the longer term.

- ADX near-term oil and gas activities will focus on delivering cash flow from the Anshof oil discovery and drilling the company making Welchau gas prospect at a time when European gas prices are approximately 4 times that of the USA.

- ADX is undertaking a farmout process to secure funding for its multiple prospect "drill ready" oil and gas portfolio which ranges from smaller low risk opportunities to larger scale higher risk targets such as the OHO prospect. In addition to the oil and gas targets, there are very attractive geothermal opportunities in the portfolio which are attracting new investment interest.

- The new Welchau prospect which has a 750 BCF (approx. 125 MMBOE equivalent) best technical prospective resource note 1 is potentially connected to a gas discovery well which tested pipeline quality gas down dip from the proposed drilling location. The Welchau prospect is in the foothills of the Austrian Alpes and is analogous to the giant anticline structures discovered in Kurdistan. The prospect is relatively shallow (approximately 2000 m) and within tie-in distance to the national gas pipeline network.

- The Gmunden multi energy resource prospect includes shallow, quick to monetise gas targets together with a deeper geothermal target assessed to have between 15 to 20 MW renewable energy potential based on similar developments in the region.

- The ZAM prospect is a follow-up to the large independently assessed OHO prospect with 20.4 MMBOE (approx. 140 BCF equivalent) best technical prospective resources (refer to ASX release dated 10 November 2021 regarding Independent Review of OHO by RISC). Similar to OHO, high quality natural gas is expected at the ZAM prospect which has technical prospective resources estimated at 15 MMBOE (approx. 100 BCF equivalent) note 1.

- An oil field rejuvenation opportunity ("Piberbach") and adjacent low risk follow-up satellite prospects.

ADX CEO, Mr Paul Fink, said, "We are delighted about the significant expansion of our exploration and appraisal portfolio in Austria. We have been able to add opportunities such as the World class Welchau gas prospect to the recent Anshof oilfield discovery within 18 months of securing our exploration licenses in Upper Austria. Success at the Welchau gas prospect would help meet the large gas supply shortfall in Europe. In addition to Welchau, several other large prospects have been added to the portfolio on trend with the independently assessed OHO prospect. At the other end of the spectrum the acreage extension includes an oilfield redevelopment project with excellent satellite follow up potential providing a low risk, rapid cash flow growth opportunity."

Note 1: The prospective resource estimates in this release are classified and reported in accordance with the PRMS – SPE Guidelines for the exploration licenses ADX-AT-I and ADX-AT-II, in the Molasse Basin, Austria. Refer to the end of this release for an explanation of prospective resource classifications used and the Basis on which the prospective resources were estimated. Prospective Resources are those estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) related to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further explorations appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

ADX Energy Ltd (ASX Code: ADX) is pleased to advise that it has reached agreement with the relevant Austrian government authorities for the significant areal extension of its Upper Austrian exploration, production and gas storage licenses. The ADX-AT-I and ADX-AT-II license areas have been expanded from 450 km2 to an area now encompassing 1022 km2. The additional license areas will be valid for a period of up to 16 years without any relinquishment foreseen commencing from 1 April 2022. In the case of a discovery, a production license with a validity of up to 60 years can be granted. In addition to exploration and production rights, ADX has also been granted the rights for gas storage.

The portfolio expansion is targeting large gas resource potential in response to Europe's gas supply shortfall as well as well as a number of other highly prospective opportunities which are summarised below:

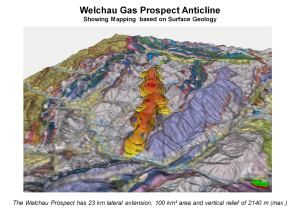

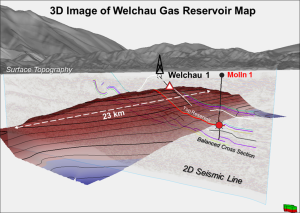

1. Welchau gas prospect (see '1' on the location map on the next page)

Welchau is a World class resource potential gas prospect whichhas a best technical prospective resource of 750 BCF (approx. 125 MMBOE equivalent) Note 2. Welchau is located in the Alpine overthrust area of the Northern Calcareous Alps up dip from the Molln-1 well which accidentally encountered a gas column in excess of 400m within Alpine thrust sheets, as illustrated in the 3D image below.

Note 2: ADX will provide further details regarding the Welchau Prospect in a dedicated release in the near future.

The Molln-1 well was drilled by OMV in 1989 targeting a much deeper oil play beneath the Alpine thrust sheets. The Molln well successfully tested pipeline quality gas from a number of tests in the same prognosed reservoir as the Welchau prospect. Welchau is analogous to the large anticlines encountered in Kurdistan and Iraq. The 100 km2 area prospect extends laterally over 23 km and has a potential gas column height in the prognosed well in excess of 1000 m. The resulting resource potential is exceptional in an area of proven gas charge but relatively low drilling cost (around 2000 m depth). The presence of a large gas column is already proven by Molln pressure data. Importantly the prospect is a relatively short tie in distance to an existing gas pipeline network. The previous licensee was a major international company that has focussed on large and deep (autochthonous) oil targets below the thrust sheets which has led to the neglect of this area for many years.

2. Conventional and geothermal overlapping targets (see '2' on the location map below)

The Gmunden prospect is a multi-energy source prospect which includes shallower gas targets as well as a deeper geothermal target which is analogous to highly successful geothermal developments in the Munich region of Germany where a fractured and often karstified Jurassic limestone reservoir is exploited for geothermal applications. The geothermal potential at Gmunden has been assessed by ADX to be capable of delivering 15 to 20 MW of long term continuous geothermal energy from a two well development. Note 3

3. OHO Trend Extension (see '3' on the location map below)

OHO is a high impact gas prospect with independently assessed best technical estimate prospective resource of 20.4 MMBOE (approx. 140 BCF equivalent) (refer to ASX release dated 10 November 2021, regarding Independent Assessment of OHO by RISC). ZAM is a follow up prospect on trend with OHO providing further upside of 15 MMBOE (approx. 100 BCF equivalent) best technical estimate prospective resources. Note 3

4. Oil field rejuvenation project & low risk satellite exploration (see '4' on the location map below)

Piberbach is an oil field rejuvenation project that has been matured to the project execution stage. In addition to the Piberbach project, the area offers low risk exploration potential, proven by several nearby oil and gas discoveries which are characterised by excellent reservoir quality resulting in high flow rates and shallow drill depths of approximately 1000 m Note 3. ADX believes this opportunity will attract potential farminees who are seeking low risk development with follow up growth.

Note 3: ADX will provide further details regarding the Upper Austria prospect inventory expansion in a dedicated release in the near future.

European Gas Market Conditions

ADX is very well placed with its expanded Austrian portfolio to commercialise oil, gas and renewable opportunities required to satisfy unmet European demand for oil and gas in the near-term as well as renewable energy in the longer term.

The European natural gas market has seen a 3.5 fold price increase in 2021 and the TTF (the most liquid natural gas pricing benchmark in Europe) has averaged circa USD 30 per mcf (USD 180 per barrel of oil equivalent) year to date. The surge in gas price is due to the combination of strong demand recovery (+5.5% in 2021), domestic production constraints (-10% in 2021), reduced pipeline deliveries (-3% in 2021) and low gas storage inventories (15% below 5-year average in September 2021).

The Ukraine-Russia conflict is putting further stress on an already tight market which has led to significant increases in liquefied natural gas (LNG) imports. Despite the fact that Europe has large and underutilised LNG regasification infrastructure, LNG has always been sourced in Europe to meet peak demand and not as a source of baseload natural gas supply which creates further uncertainties in relation to the use of LNG for continuous supply.

Europe's determination to reduce its dependency on Russian gas supplies (representing circa 30% of the total gas supplies in Europe in 2021) has been further strengthened by recent natural gas interruptions to Poland and Bulgaria by Gazprom.

Investment Strategy

ADX's immediate oil and gas activities will focus on delivering cash flow from the Anshof oil discovery and drilling the company making Welchau gas prospect at a time when European gas prices are approximately 4 times that of the USA. There is significant investment interest in geothermal projects from companies focussed on geothermal developments in Europe. ADX has already been approached by a number of potential partnership opportunities for geothermal projects.

Farmout Process

ADX has a very rich prospect inventory developed due to ADX's access to a large state of the art 3D data set and the experience of our people who worked for a dominant company in Upper Austria before joining ADX. In order to secure funding across the portfolio, ADX is undertaking a farmout process to accelerate the drilling of its drill ready oil and gas inventory which ranges from smaller low risk opportunities to larger scale higher risk targets such as OHO. In addition to the oil and gas targets there are appealing geothermal opportunities in the portfolio which are also attracting investment interest.

Further Exploration Project Information

ADX will provide a comprehensive shareholder release providing further details regarding the Welchau prospect in the near future. ADX will also provide a comprehensive review of the Upper Austria prospect inventory expansion for all the drilling opportunities in addition to Welchau.

For further details please contact:

| Paul Fink | Ian Tchacos |

| Chief Executive Officer | Executive Chairman |

| +61 (08) 9381 4266 | +61 (08) 9381 4266 |

| paul.fink@adx-energy.com | ian.tchacos@adxenergy.com.au |

Authorised for lodgement by Ian Tchacos, Executive Chairman

Persons compiling information about Hydrocarbons:

Pursuant to the requirements of the ASX Listing Rule 5.31, 5.41 and 5.42 the technical and reserves information relating to Austria contained in this release has been reviewed by Paul Fink as part of the due diligence process on behalf of ADX. Mr. Fink is Technical Director of ADX Energy Ltd is a qualified geophysicist with 23 years of technical, commercial and management experience in exploration for, appraisal and development of oil and gas resources. Mr. Fink has reviewed the results, procedures and data contained in this release and considers the resource estimates to be fairly represented. Mr. Fink has consented to the inclusion of this information in the form and context in which it appears. Mr. Fink is a member of the EAGE (European Association of Geoscientists & Engineers) and FIDIC (Federation of Consulting Engineers).

Reporting Standards for Resource Estimation

Reserves and resources are reported in accordance with the definitions of reserves, contingent resources and prospective resources and guidelines set out in the Petroleum Resources Management System (PRMS) prepared by the Oil and Gas Reserves Committee of the Society of Petroleum Engineers (SPE) and reviewed and jointly sponsored by the American Association of Petroleum Geologists (AAPG), World Petroleum Council (WPC), Society of Petroleum Evaluation Engineers (SPEE), Society of Exploration Geophysicists (SEG), Society of Petrophysicists and Well Log Analysts (SPWLA) and European Association of Geoscientists and Engineers (EAGE), revised June 2018.

Prospective Resource Classifications

Low Estimate scenario of Prospective Resources ‐ denotes a conservative estimate of the quantity that will actually recovered from an accumulation by an oil and gas project. When probabilistic methods are used, there should be at least a 90% probability (P90) that the quantities actually recovered will equal or exceed the low estimate.

Best Estimate scenario of Prospective resources - denotes the best estimate of the quantity that will actually be recovered from an accumulation by an oil and gas project. It is the most realistic assessment of recoverable quantities if only a single result were reported. When probabilistic methods are used, there should be at least a 50 % probability (P50) that the quantities actually recovered will equal or exceed the best estimate.

High Estimate scenario of Prospective Resources - denotes an optimistic scenario of the quantity that will actually be recovered from an accumulation by an oil and gas project. When probabilistic methods are used, there should be at least a 10% probability that the quantities actually recovered will be equal or exceed the high estimate.

ADX has only reported Best Estimate Prospective Resources Scenarios in this release.

Nomenclature and conversions used in this release

BBL means US barrel

MMBBLS means millions of US barrels

MCF means thousand cubic feet

MMCF means million cubic feet

BCF means billion cubic feet

TCF meanstrillion cubic feet

BOE means barrels of oil equivalent

MMBOE means millions of barrels of oil equivalent

MW means Megawatts

Oil to gas energy equivalent conversion: 1 BBL = 6 MCF

End of this Release

(end)

| Emitter: |

ADX Energy Ltd. Canovagasse 5 1010 Wien Austria |

|

|---|---|---|

| Contact Person: | DI Paul Fink | |

| Phone: | +43 (0)50 724 5666 | |

| E-Mail: | paul.fink@adx-energy.at | |

| Website: | www.adx-energy.com | |

| ISIN(s): | AU000000ADX9 (Share) | |

| Stock Exchange(s): | Free Market in Berlin, Frankfurt, Hamburg, Munich, Stuttgart, Tradegate | |

| Other Stock Exchanges: | Australian Securities Exchange (ASX), Sydney |