Ad hoc announcement pursuant to Art. 53 LR

HOCHDORF Holding AG: Positive operating result for HOCHDORF – approach of investors launched

Hochdorf (pta010/21.03.2024/07:07 UTC+1)

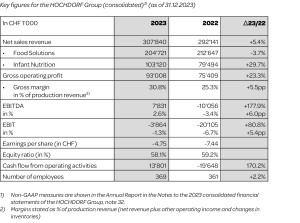

The HOCHDORF Group is continuing to successfully implement its transformation process and achieved its target of positive EBITDA of CHF 7.8 million by the end of 2023. Significant growth in the Infant Nutrition division (+29.7%) made a major contribution to the result. The 5.5 percentage point year-on-year increase in the gross margin (30.8%) and the positive operating cash flow of CHF 13.8 million (2022: CHF -19.6 million) underline the operational turnaround. Despite competitive earning power, financial legacy burdens, however, remain a significant strain. The approach of investors has been launched.

Ralph Siegl, CEO and Delegate of the Board of Directors of the HOCHDORF Group said: "Under difficult conditions on the milk market, we have proven that our strategic direction is right and that we have a profitable and cash-positive business model with considerable development potential. The market is aware of HOCHDORF's unique expertise in the field of milk powder technology and milk protein refinement. Apart from our outreach to finding an investor committed to continue the business on sustainable economic basis, our focus for 2024 is on ensuring a positive EBIT."

The Group's net sales revenue increased by 5.4% from CHF 292.1 million in 2022 to CHF 307.8 million. Two intentional strategic factors provided the basis for this positive development: firstly, strong growth within Infant Nutrition, particularly in markets in the MENA region and Central America. Secondly, the consistent focus on earnings quality in the Food Solutions division.

Infant formula "made in Switzerland": significant growth

The Infant Nutrition division increased by 29.7% to CHF 103.1 million. The compelling aspects of infant formula from HOCHDORF, both on international markets and in the Swiss domestic market, are the quality of the formulation which is based on the latest scientific knowledge and the "Swissness" of the products. Accordingly, marketing focus was increasingly placed on the use and processing of Swiss milk that fulfils 100% of the high standards of "Swissmilk Green".

At -3.7% compared to the previous year, the Food Solutions division reported slightly lower net sales of CHF 204.7 million, in line with the strategy. The significant increase again in 2023 in the difference between the Swiss reference prices for milk and the prices in the EU, combined with a corresponding delay in the dairy industry's export price compensation mechanism, had a negative impact on the result.

HOCHDORF remains one of the main pillars of the Swiss dairy industry in 2023. It will remain in this position but must also safeguard its commercial principles. This also requires profitable utilisation in phases with milk surpluses. Since the start of 2024, HOCHDORF has been providing additional drying capacity for unbudgeted milk volumes to support the traditional Swiss dairy industry in overcoming the current challenges.

Significant increase in gross margin – positive cash flow

Operating cash flow – a key figure that was last positive in the 2017 financial year – amounted to CHF 13.8 million as at 31 December 2023. The target of positive EBITDA in 2023 was clearly achieved at CHF 7.8 million. EBIT was negative at CHF -3.9 million (previous year: CHF -20.1 million), as was the net result at CHF -10.2 million (previous year: CHF -15.8 million).

The gross margin continued to develop favourably at 30.8% thanks to consistent streamlining of the portfolio and a demand-oriented milk procurement policy.

Operating expenses of CHF -85.2 million were in line with the previous year (CHF -85.5 million).

Dividend waiver, hybrid bond interest payments

The equity ratio at the end of 2023 was 58.1% and net debt CHF 52.4 million.

Due to the continued high level of debt, the Board of Directors is proposing to the Annual General Meeting on 15 May 2024 that no dividend is paid for the 2023 business year. As a result, HOCHDORF will also defer the interest payments for the hybrid bond for a further year on the next call date of 21 June 2024.

The HOCHDORF Group's short and medium-term financing is secured with an existing syndicated loan at HOCHDORF Swiss Nutrition Ltd level with a term of two years.

Search for investors intensified

Despite competitive earning power, this, for the foreseeable future, will not be sufficient to bear the increasing legacy burdens incurred before 2020. As announced on 5 March 2024, potential investors are therefore currently being approached. The main focus here is on the preservation of the operating business as well as of existing jobs. No decision has, yet, been made.

As communicated on 11 September 2023, the consolidation of production in Sulgen has been decided. Production at the Hochdorf site will cease by mid-2026 at the latest, with the administrative staff remaining on site. Some facilities will be added in Sulgen, as required for high-margin infant formula and selected specialities.

Goal: positive EBIT by the end of 2024

For the next strategic transformation phase of change, the HOCHDORF Group requires additional capital and a solution to resolve legacy issues. "To take our cash-positive business model into the next phase, we need to invest in our facilities, in our employees and in further business development. We can only achieve this with additional financing options," said Andreas Herzog, Vice Chairman of the Board of Directors, on the current status of the intensified search for investors.

Operationally, efforts are focussed on the goal of achieving positive EBIT by the end of 2024.

___

Material to download and further information

• Presentation of Annual Results: 21 March 2024, 10 am. Dial-in webcast: https://media.choruscall.eu/mediaframe/webcast.html?webcastid=0XD2BAwv / by phone: https://services3.choruscall.ch/DiamondPassRegistration/register?confirmationNumber=3680243&linkSecurityString=5c75c6988

• The online version of the Annual Report will be available at from 7 am on 21 March 2024 at https://report.hochdorf.com/2023/ar/en/home

• Direct link to download the PDF version: https://report.hochdorf.com/2023/ar/downloads/en/Hochdorf_Annual_Report_2023.pdf

• Media releases by e-mail / Investor News Service: www.hochdorf.com/en/newsletter/

• Overview of ad hoc press releases of the HOCHDORF Group: https://www.hochdorf.com/en/media/ad-hoc-announcements/

• Picture material: on request / Keystone: https://visual.keystone-sda.ch/lightbox/-/lightbox/page/2047447/1

Dates

• 15 May 2024: Annual General Meeting

• 29 August 2024: Half-Year Results

(end)

| Emitter: |

HOCHDORF Holding AG Siedereistrasse 9 6281 Hochdorf Switzerland |

|

|---|---|---|

| Contact Person: | Marlène Betschart | |

| Phone: | +419146583 / +41792452410 | |

| E-Mail: | marlene.betschart@hochdorf.com | |

| Website: | www.hochdorf.com | |

| ISIN(s): | CH0024666528 (Share) | |

| Stock Exchange(s): | SIX Swiss Exchange |