Business news for the stock market

OMRON Corporation: Notice Regarding Disposal of Treasury Stock

as Medium-term Incentive Plan for Employee Stockholding Association Using Restricted Stock

Kyoto (pta015/01.03.2022/10:29 UTC+1)

March 1, 2022

Notice Regarding Disposal of Treasury Stock as Medium-term Incentive Plan for Employee Stockholding Association Using Restricted Stock

OMRON Corporation (TOKYO: 6645; ADR: OMRNY) announces that at a meeting of Board of Directors held today (March 1, 2022), it resolved to introduce an medium-term incentive plan (hereinafter, the "Plan") for employee stockholding association using restricted stock targeting the manager class of OMRON Corporation and its subsidiaries in Japan(hereinafter, "subsidiaries") and resolved to dispose of treasury stock as restricted stock (hereinafter, the "Treasury Stock Disposal" or "Disposal"), with the OMRON Employee Stockholding Association (hereinafter, the "ESA") as the scheduled allottee, as described below.

1. Outline of the Disposal

| (1) | Date of disposal | May 31, 2022 |

| (2) | Class and number of shares to be disposed of | 115,350 shares of common stock of OMRON Corporation (Note) |

| (3) | Disposal price | 7,760 yen per share |

| (4) | Total value of disposal | 895,116,000 yen (Note) |

| (5) | Method of disposal (Scheduledallottee) | Third-party allotment (OMRON Employee Stockholding Association: 115,350 shares) Note that OMRON Corporation will not accept any application from OMRON Corporation employees for subscribing for only a part of the shares to be granted. |

| (6) | Other | The Treasury Stock Disposal is subject to effectuation of a Securities Registration Statement pursuant to the Financial Instruments and Exchange Act. |

(Note) The figures for the "number of shares to be disposed of" and "total value of disposal" represent the maximum amount. The actual number of shares to be disposed of and the actual total value of disposal are expected to be fixed according to the number of employees of OMRON Corporation and its subsidiaries after the conclusion of promoting membership of the ESA to those who have not yet joined and confirming the consent of members regarding the Plan.

2. Purpose and Reasons for the Disposal

Based on its new long-term vision "SF2030," which was announced on March 1, 2022, OMRON Corporation will conduct business management in which management and employees will join hands with shareholders to improve corporate value toward realizing the "maximization of corporate value (financial value + non-financial value)" and share the achievements among one another. As part of such efforts, OMRON Corporation resolved to adopt the Plan to provide those among the manager class employees of OMRON Corporation and its subsidiaries who are members of the ESA and who have agreed to the Plan (hereinafter, the "Eligible Employees") with opportunities for acquiring the restricted stock (OMRON Corporation’s common stock) to be issued or disposed by OMRON Corporation through the ESA so as to support property accumulation of the Eligible Employees, as well as to heighten their interest in the corporate value of OMRON Corporation and to revitalize the ESA further.

The outline of the Plan is as follows.

[Outline of the Plan]

In the Plan, OMRON Corporation will pay monetary claims as a special incentive for granting restricted stock (hereinafter the "Special Incentive") to the Eligible Employees, and the Eligible Employees will contribute their Special Incentive to the ESA. Subsequently, the Eligible Employees can receive the issuance or disposal of the OMRON Corporation’s common stock as the restricted stock through the ESA by the ESA contributing in-kind, to OMRON Corporation, the Special Incentive contributed by the Eligible Employees.

The amount per share to be paid for OMRON Corporation’s common stock in cases where such common stock is to be newly issued or disposed of based on the Plan shall be determined by the Board of Directors to the extent that it is not particularly advantageous to the ESA (and by extension to the Eligible Employees) based on the closing price of OMRON Corporation’s common stock on the Tokyo Stock Exchange on the business day immediately preceding the date of the resolution by the Board of Directors (or the closing price on the transaction day immediately prior thereto if no transaction is made on such business day).

In issuing or disposing of OMRON Corporation’s common stock based on the Plan, OMRON Corporation and the ESA will execute a restricted stock allotment agreement, the outline of which includes (1) the ESA are prohibited from transferring, creating any security interest on, or otherwise disposing of the allotted share to a third party during a certain restriction period (hereinafter the "Restriction"), and (2) OMRON Corporation shall make acquisition of the allotted share without payment of any contribution if certain events occur. Furthermore, the Special Incentive will be paid to the Eligible Employees on the condition that the restricted stock allotment agreement is executed between OMRON Corporation and the ESA.

Moreover, with regard to one’s member equity interest pertaining to the restricted stock acquired by the ESA (hereinafter the "Restricted Stock Equity Interest" or "RS Equity Interest") through issuance or disposal, an Eligible Employee will be restricted from withdrawing the restricted stock corresponding to the Restricted Stock Equity Interest until the Restriction of the restricted stock is lifted based on the ESA Rules, the ESA Detailed Operation Rules and other rules of the ESA (hereinafter collectively the "ESA Rules, etc.") (Note).

(Note) The ESA is scheduled to resolve for amendment to the ESA Rules, etc. in order to comply with the Plan prior to receiving the Treasury Stock Disposal at the meeting of the ESA’s governing body to be held promptly after the date of resolution of OMRON Corporation’s Board of Directors’ meeting. Such amendment is scheduled to become effective when two weeks pass from the date of such meeting of the ESA’s governing body, and the number of objections from the ESA members is less than one third of the total number of the ESA members.

In the Treasury Stock Disposal, OMRON Corporation’s common stock (hereinafter the "Allotted Shares") will be disposed to the ESA as a result of the ESA as the scheduled allottee contributing all of the Special Incentive contributed from the Eligible Employees as contribution in-kind to OMRON Corporation based on the Plan. In the Treasury Stock Disposal, the outline of the restricted stock allotment agreement to be executed between OMRON Corporation and the ESA (hereinafter the "Allotment Agreement") is as described in "3. Outline of Allotment Agreement" below. While the number of shares to be disposed in the Treasury Stock Disposal is expected to become fixed in due course as indicated in (Note) of 1. above, 115,350 shares are scheduled to be disposed to the ESA as the maximum amount. Note that the scale of dilution based on the Treasury Stock Disposal is, when based on the foregoing maximum amount, 0.06% (rounded off to two decimal places; hereinafter the same in the calculation of percentages) against 206,244,872 shares as the total number of issued shares as of September 30, 2021, and is 0.28% against the total number of voting rights that include 2,022,334 voting rights as the total number of voting rights as of September 30, 2021, reflecting 1,094 voting rights that increased due to the disposal of treasury stock based on the special incentive scheme resolved today, and 3,327 voting rights that increased due to the disposal of treasury stock for Stockholding Association Revitalization Plan .

Note that the Treasury Stock Disposal will be implemented on the condition that the revised ESA Rules, etc. become effective by the day before the date of disposal of the Treasury Stock Disposal.

3. Outline of Allotment Agreement

(1) Transfer restriction period

From May 31, 2022 to May 31, 2025

(2) Condition for lifting of Restriction

On the condition that an Eligible Employee had been a member of the ESA on a continuing basis during the Restriction period, the Restriction will be lifted on the first business day after the expiration of the Restriction period for the total number of Allotted Shares according to the Restricted Stock Equity Interest held by the Eligible Employee, based on the attainment of performance targets (hereinafter, the "Performance Conditions") and changes in the employee category of the Eligible Employee. In the foregoing case, OMRON Corporation shall notify the ESA regarding the lifting of the Restriction and the number of Allotted Shares for which the Restriction will be lifted, and the ESA shall, pursuant to the provisions of the ESA Rules, etc., transfer the portion according to the Allotted Shares for which the Restriction was lifted out of the Restricted Stock Equity Interest held by the Eligible Employee who satisfied the foregoing condition to the member equity interest (hereinafter the "Ordinary Equity Interest") held by the Eligible Employee in relation to the share acquired by the ESA not based on the Plan. Note that the Performance Conditions are as indicated in

(3) Treatment upon terminating membership of the ESA

In cases where an Eligible Employee terminates membership (refers to cases where the employee loses membership qualification or applies for termination of membership, and includes termination of membership due to death) of the ESA during the Restriction period upon reaching retirement age or any other justifiable cause (includes termination upon the request of OMRON Corporation or its subsidiary and upon OMRON Corporation or its subsidiary deeming continuation of service by the Eligible Employee to be difficult on the basis of illness or other compelling reasons; the same applies hereinafter), OMRON Corporation shall lift the Restriction for the number of shares (any amount less than 1 share is rounded off) that is derived by multiplying the number of shares prescribed in (a) below by the number prescribed in (b) below on the day when OMRON Corporation receives the application for termination (hereinafter, the "Termination Application Reception Date." In the case of termination due to death of the Eligible Employee, it shall be the date on which OMRON Corporation learns of the death of the Eligible Employee. However, if the Termination Application Reception Date is between March 31, 2025, and May 31, 2025, the Restriction shall be lifted on the first business day after the expiration of the Restriction period.).

(a) The standard number of shares granted as prescribed in

(b) A number derived by dividing the number of months which are subject to this plan from April 1, 2022 to March 31, 2025 (hereinafter, the "Performance Evaluation Period") by 36

(4) Acquisition without contribution by OMRON Corporation

OMRON Corporation will automatically acquire through acquisition without contribution the Allotted Shares for which the Restriction is not lifted as of the expiration of the Restriction period or as of the lifting of the Restriction prescribed in (3) above. In the foregoing case, OMRON Corporation shall notify the ESA and the Eligible Employees regarding its acquisition without contribution of the Allotted Shares and the number of Allotted Shares to be acquired through the acquisition, and the ESA shall deduct the portion according to the Allotted Shares to be acquired through the acquisition out of the Restricted Stock Equity Interest held by the Eligible Employees at such point in time according to the provisions of the ESA Rules, etc.

(5) Management of shares

During the Restriction period, the Allotted Shares shall be managed in a dedicated account opened by the ESA at Nomura Securities Co., Ltd. in order to ensure that the ESA neither transfers, creates any security interest on, nor otherwise disposes of the Allotted Shares during that period. Furthermore, the ESA shall register and manage, pursuant to the provisions of the ESA Rules, etc., the Restricted Stock Equity Interest to be held by the Eligible Employees in relation to the Allotted Shares separately from the Ordinary Equity Interest held by the Eligible Employees in relation to the share acquired by the ESA not based on the Plan.

(6) Treatment upon reorganization, etc.

In cases where, during the Restriction period, a general meeting of shareholders of OMRON Corporation (however, in cases where the reorganization, etc., in question does not require approval from a general meeting of shareholders of OMRON Corporation, the Board of Directors of OMRON Corporation) approves a merger agreement wherein OMRON Corporation becomes the extinct company, or a share exchange agreement or a share transfer plan wherein OMRON Corporation becomes a wholly-owned subsidiary, or other matters regarding reorganization, etc., based on the resolution of the Board of Directors, the Restriction may be lifted for the total number of the Allotted Shares according to the Restricted Stock Equity Interest held by the Eligible Employees among the Allotted Shares held by the ESA on the date of the approval in question immediately before the business day preceding the effective date of the reorganization, etc.

4. Basis of Calculation and Specific Details of the Disposal Amount

The Treasury Stock Disposal to the ESA as the scheduled allottee is conducted by the Eligible Employees contributing the Special Incentive to the ESA for the granting of restricted stock as property contributed in kind. To eliminate any arbitrariness in the disposal amount, the closing price of OMRON Corporation’s common stock on the First Section of the Tokyo Stock Exchange on February 28, 2022 (the business day prior to the day of the resolution of the Board of Directors) of 7,760 yen is used as the disposition price. As this is the market price immediately prior to the day of the resolution of the Board of Directors, OMRON Corporation believes that it is rational and not particularly an advantageous price.

Note that the deviation rate (rounded off to two decimal places) of this price from the average closing price of OMRON Corporation shares on the First Section of the Tokyo Stock Exchange is as follows.

| Period | Average closing price (any amount less than 1 yen is rounded off) | Deviation rate |

| 1 month (February 1, 2022 to February 28, 2022) | 8,076 yen | -3.91% |

| 3 months (December 1, 2021 to February 28, 2022) | 9,986 yen | -22.29% |

| 6 months (September 1, 2021 to February 28, 2022) | 10,518 yen | -26.22% |

All 4 Audit & Supervisory Board Members (including 2 Outside Audit & Supervisory Board Members) who attended the meeting of the Board of Directors held today have expressed their opinion that OMRON Corporation’s process of determining that the foregoing disposal price will not be particularly advantageous to the ESA as the allottee is reasonable, and that such determination is legitimate, in light of the fact that the purpose of the Treasury Stock Disposal is to introduce the Plan and that the disposal price is the closing price on the previous business day immediately preceding the date of the resolution of the Board of Directors.

5. Matters related to procedures under the Code of Corporate Conduct

With regard to the Treasury Stock Disposal, since (1) the dilution rate is less than 25% and (2) it does not involve the change of the controlling shareholder, there is no need to take procedures for acquiring the opinion of an independent third party and confirming the intention of shareholders as set forth in Article 432 of the listing regulations prescribed by the Tokyo Stock Exchange.

(Reference)

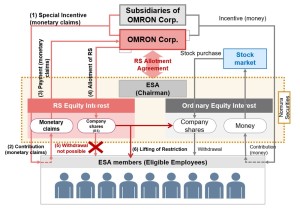

[Structure of the Plan]

- OMRON Corporation and its subsidiaries grant monetary claims as Special Incentive to certain members who are eligible to join the stockholding association.

- The members who agreed to the Plan contribute the monetary claims of (1) above to the ESA.

- The ESA contributes the monetary claims contributed in (2) above to OMRON Corporation.

- OMRON Corporation allots Allotted Shares to the ESA.

- The Allotted Shares are deposited in the ESA’s RS Equity Interest account through Nomura Securities Co., Ltd., and the withdrawal thereof are restricted during the Restriction period.

- After lifting of the Restriction, Eligible Employees may withdraw the Allotted Shares in the same manner as the ESA’s Ordinary Equity Interest account.

The number of shares for which the Restriction is lifted shall be the number derived from the following formula based on the evaluation standard set forth by OMRON Corporation.

Number of shares for which Restriction is lifted = A + (1) + (2)

A: Standard number of shares granted

| Employee category | Manager class |

| Employee | 60 shares (20 shares × 3 years) |

| Senior employee | 48 shares (16 shares × 3 years) |

| 4-day week senior employee | 36 shares (12 shares × 3 years) |

| 3- day week senior employee | 24 shares (8 shares × 3 years) |

Note: If the standard number of shares granted decreases during the Performance Evaluation Period due to changes in the employee category of the Eligible Employee, the number of shares will be adjusted based on the number of months.

B: Number of shares granted = A × 120% (any fraction of a share is rounded up)

| Employee category | Manager class |

| Employee | 72 shares |

| Senior employee | 58 shares |

| 4-day week senior employee | 44 shares |

| 3- day week senior employee | 29 shares |

Financial value and non-financial value shall be evaluated at a proportion of 70% and 30%,

respectively, as shown below.

| (1) Financial value | Group consolidated operating income (Increases linearly according to the overachievement rate of medium-term management plan targets) |

| (2) Non-financial value | Selection for inclusion in DJSI World Index ・Selected for two years out of three: 110% ・Selected for three consecutive years: 120% |

Note: (1) will be fixed on the announcement day of full-year results for FY ending March 2024.

(2) will be fixed on the announcement day of DJSI World Index in 2024.

Formula for performance evaluation (Example)

| Attainment rate | (1) Financial value | (2) Non-financial value |

| 120% | (B−A) × 0.7 × 1 | (B−A) × 0.3 |

| 110% | (B−A) × 0.7 × 0.5 | (B−A) × 0.3 × 0.5 |

| 100% | (B−A) × 0.7 × 0 | 0 |

(end)

| Emitter: |

OMRON Corporation Shiokoji Horikawa, Shimogyo-ku 600-8530 Kyoto Japan |

|

|---|---|---|

| Contact Person: | Jan Hutterer | |

| Phone: | +49 172 3462831 | |

| E-Mail: | jan.hutterer@kirchhoff.de | |

| Website: | www.omron.com | |

| ISIN(s): | DE0008647488 (Share) JP3197800000 (Share) | |

| Stock Exchange(s): | Regulated Market in Frankfurt; Free Market in Berlin, Hannover, Stuttgart | |

| Other Stock Exchanges: | NASDAQ, Tokio |