Business news for the stock market

OMRON Corporation: Notice Regarding Disposal of Treasury Stock as Granting of Shares Through Employee Stockholding Association

Kyoto (pta014/01.03.2022/10:13 UTC+1)

March 1, 2022

Notice Regarding Disposal of Treasury Stock as Granting of Shares Through Employee Stockholding Association

OMRON Corporation (TOKYO: 6645; ADR: OMRNY) announces that at a meeting of Board of Directors held today (March 1, 2022), it resolved to grant shares to employees of OMRON Corporation and its subsidiaries in Japan (hereinafter, "subsidiaries") though the employee stockholding association (hereinafter, the "Scheme") and resolved to dispose of treasury stock through third-party allotment (hereinafter, the "Treasury Stock Disposal" or "Disposal"), with the OMRON Employee Stockholding Association as the scheduled allottee, as described below.

1. Outline of the Disposal

| (1) | Date of disposal | May 17, 2022 |

| (2) | Class and number of shares to be disposed of | 109,480 shares of common stock of OMRON Corporation (Note) |

| (3) | Disposal price | 7,760 yen per share |

| (4) | Total value of disposal | 849,564,800 yen (Note) |

| (5) | Method of disposal (Scheduled allottee) | Third-party allotment (OMRON Employee Stockholding Association: 109,480 shares) (The number of shares is calculated assuming that 10 shares will be granted to the largest number of employees of OMRON Corporation and its subsidiaries eligible for the scheme, which is 10,948.) Note that OMRON Corporation will not accept any application from OMRON Corporation employees for subscribing for only a part of the shares to be granted. |

| (6) | Other | The Treasury Stock Disposal is subject to effectuation of a Securities Registration Statement pursuant to the Financial Instruments and Exchange Act. |

(Note) The figures for the "number of shares to be disposed of" and "total value of disposal" represent the maximum amount. The actual number of shares to be disposed of and the actual total value of disposal are expected to be fixed according to the number of members joined to OMRON Employee Stockholding Association (hereinafter, the "ESA") after the conclusion of promoting membership of ESA to those who have not yet joined.

2. Purpose and Reasons for the Disposal

Upon commencing its new long-term vision "SF2030," which was announced on March 1, 2022, OMRON Corporation has decided to grant common stock it issued (hereinafter, "OMRON Shares") to members of the stockholding association (hereinafter, "Members") as a special incentive, with the aim of boosting the sensitivity of the employees of OMRON Corporation and its subsidiaries to corporate value and their awareness toward improving it, as well as encouraging them to join the stockholding association.

In the Scheme, OMRON Corporation grants a special incentive to Members and disposes of treasury stock by third-party allotment to the ESA in exchange for contribution of said special incentive. As indicated in (Note) of "1. Outline of the Disposal," the number of shares to be disposed of to the ESA will be determined at a later date, but will be a maximum of 109,480shares.

Note that the scale of dilution based on the Treasury Stock Disposal is 0.05% against 206,244,872 shares as the total number of issued shares as of September 30, 2021, and 0.05% against 2,022,334 voting rights as the total number of voting rights as of September 30, 2021 (both percentages are rounded off to two decimal places).

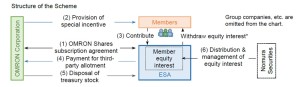

Structure of the Scheme

(1) OMRON Corporation enters into a stock subscription agreement for disposal and subscription of treasury stock with the ESA.

(2) OMRON Corporation provides a special incentive to Members.

(3) Members contribute the special incentive provided to them to the ESA.

(4) The ESA collects the special incentives contributed by Members and pays for the third-party allocation of shares.

(5) OMRON Corporation disposes of treasury stock to the ESA.

(6) The allotted OMRON Shares are distributed to and managed for Members in the ESA through the outsourcing of stock administration by the ESA to Nomura Securities, Co., Ltd.

* Members may withdraw the allotted OMRON Shares to brokerage accounts in their individual names.

3. Basis of Calculation and Specific Details of the Disposal Price

The Treasury Stock Disposal to the ESA as the scheduled allottee is for the purpose of introducing the Scheme. To eliminate any arbitrariness in the disposal price, the closing price of OMRON Corporation’s common stock on the First Section of the Tokyo Stock Exchange on February 28, 2022 (the business day prior to the day of the resolution of the Board of Directors) of 7,760 yen is used as the disposition price. As this is the market price immediately prior to the day of the resolution of the Board of Directors, OMRON Corporation believes that it is rational and not particularly an advantageous price.

Note that the deviation rate (rounded off to two decimal places) of this price from the average closing price of OMRON Shares on the First Section of the Tokyo Stock Exchange is as follows.

| Period | Average closing price (any amount less than 1 yen is rounded off) | Deviation rate |

| 1 month (February 1, 2022 to February 28, 2022) | 8,076 yen | -3.91% |

| 3 months (December 1, 2021 to February 28, 2022) | 9,986 yen | -22.29% |

| 6 months (September 1, 2021 to February 28, 2022) | 10,518 yen | -26.22% |

All 4 Audit & Supervisory Board Members (including 2 Outside Audit & Supervisory Board Members) who attended the meeting of the Board of Directors held today have expressed their opinion that OMRON Corporation’s process of determining that the foregoing disposal price will not be particularly advantageous to the ESA as the allottee is reasonable, and that such determination is legitimate, in light of the fact that the purpose of the Treasury Stock Disposal is to introduce the Scheme and that the disposal price is the closing price on the business day immediately preceding the date of the resolution of the Board of Directors.

4. Matters related to procedures under the Code of Corporate Conduct

With regard to the Treasury Stock Disposal, since (1) the dilution rate is less than 25% and (2) it does not involve the change of the controlling shareholder, there is no need to take procedures for acquiring the opinion of an independent third party and confirming the intention of shareholders as set forth in Article 432 of the listing regulations prescribed by the Tokyo Stock Exchange.

(end)

| Emitter: |

OMRON Corporation Shiokoji Horikawa, Shimogyo-ku 600-8530 Kyoto Japan |

|

|---|---|---|

| Contact Person: | Jan Hutterer | |

| Phone: | +49 172 3462831 | |

| E-Mail: | jan.hutterer@kirchhoff.de | |

| Website: | www.omron.com | |

| ISIN(s): | DE0008647488 (Share) JP3197800000 (Share) | |

| Stock Exchange(s): | Regulated Market in Frankfurt; Free Market in Berlin, Hannover, Stuttgart | |

| Other Stock Exchanges: | NASDAQ, Tokio |