Ad hoc announcement according to article 53 KR

Georg Fischer AG: Ad hoc announcement

Ad hoc announcement pursuant to Article 53 of Listing Rules (LR) of the SIX Exchange Regulation AG

Schaffhausen (pta006/20.07.2022/07:00 UTC+2)

Schaffhausen

20 July 2022, 7:00 a.m. CET

The full version of the GF Mid-Year Report 2022 incl. presentation is available on www.georgfischer.com/mid-year-report.

The presentation of the Mid-Year results will take place on 20 July at 10:00 a.m. via Audio Webcast

Content of ad hoc announcement:

Significant profitability increase, further step towards 2025 targets

- Sales rose 7.4% to CHF 1'971 million, corresponding to an organic growth of 11.1% thanks to GF's strong market position in all three divisions

- Operating result increased 26.9% to CHF 179 million, with a significant increase of the EBIT margin to 9.1%

- Well-balanced global footprint pays off with strong organic sales in the US (+25.5%) and Europe (+11.7%)

- Business in China started to recover as COVID-19 lockdowns ease

- Supply chain disruptions impact business, but are mitigated thanks to localized production

- Implementation of Strategy 2025 well on track; strong focus on customer value

The well-balanced global footprint, diversified portfolio as well as strong market position of all three divisions proved their worth in times of increased uncertainty. In the first half of 2022, GF's business continued to experience strong growth, despite an increasingly volatile market environment. Organic sales across all three divisions were strong, mainly driven by the US and Europe. This favorable development mitigated the impact of the COVID-19 lockdowns across China, which affected several production sites. Continued pressure on supply chains, raw material scarcity, and increasing prices, exacerbated by the war in Ukraine, continue to affect many industries, from automotive to consumer goods electronics.

Sustainability-driven innovations, a focus of GF's Strategy 2025, continued to deliver promising solutions and applications for numerous attractive market segments. Solutions for water treatment as well as solutions to minimize water losses in urban infrastructure, light metal components to help reduce CO2e emissions of e-vehicles, and highly energy efficient machine tools are tangible examples of how GF is leveraging its innovative strength to address the sustainability needs of its customers.

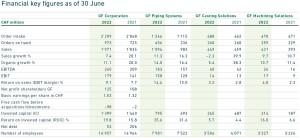

Results at the corporate level

Order intake increased 7.9% (11.6% organically) in the first half of 2022 and reached an all-time high of CHF 2'209 million. Sales amounted to CHF 1'971 million, a 7.4% increase compared with the first half of 2021, fueled by strong US and European markets across the three divisions as well as price adjustments. Organically, sales rose 11.1%. Currency effects negatively impacted sales by CHF 51 million.

The operating result (EBIT) rose 26.9% to CHF 179 million, with a corresponding EBIT margin of 9.1%. In the same period a year ago, these were CHF 141 million and 7.7%, respectively. Net profit attributable to shareholders amounted to CHF 125 million, compared with CHF 108 million in the first half of 2021, an increase of 15.6%. Free cash flow came in at minus CHF 37 million (2021: minus CHF 32 million). Before acquisitions/divestments, the free cash flow was minus CHF 98 million (2021: minus CHF 2 million). Year-end guidance for a strong positive free cash flow remains unchanged. GF's solid market position and the successful financial performance in the first half of the year allowed GF to maintain its very robust balance sheet, reflected in an equity ratio of 41.8% (30 June 2021: 39.4%).

GF Piping Systems

The division recorded another strong performance, thanks to its presence in growth markets and segments that address important sustainability needs, such as water treatment and urban infrastructure, microelectronics and process automation. These industries played a key role for growth in the Americas and in Europe, and mitigated the effects of the COVID-19 lockdowns in China. Input price increases were successfully passed on to the market and also contributed to growth.

Sales rose to CHF 1'094 million, an 11.3% increase compared with the first half of 2021. Organically, sales rose 14.0%. The operating profit stood at CHF 158 million (2021: CHF 128 million), for an EBIT margin of 14.4% (2021: 13.0%), which is already within the division's target range of GF's Strategy 2025.

GF Casting Solutions

GF Casting Solutions reached CHF 449 million in sales, a 2.3% decrease that is mainly attributable to the divestment of the joint venture GF Linamar LLC, Mills River (USA) at the end of March. Customer demand was subdued due to supply chain disruptions, the war in Ukraine and several COVID-19 lockdowns across China. Organically, sales rose 5.4%, positively driven by an increase of shipments for e-vehicle components and higher metal prices. EBIT came in at CHF 14.5 million (2021: CHF 13.2 million), higher than in the previous year, thanks to a stronger second quarter.

GF Casting Solutions' new light metal production facility in Shenyang (China) is ramping up and the unit has successfully delivered first parts to its automotive customers.

The division entered into a strategic partnership with Mexico-based Bocar Group, a light-metal castings and assemblies solutions provider. This enables GF Casting Solutions to develop and invest in new technologies and services to support customers in North America, Europe and China on their way to sustainable mobility. The partnership agreement follows the divestment of GF's 50% stake in the joint venture GF Linamar LLC. The division's strategic targets for 2025 remain unchanged.

GF Machining Solutions

GF Machining Solutions achieved an order intake of CHF 478 million, resulting in a solid book-to-bill ratio of 1.1. The division reported sales of CHF 431 million in the first half of this year (2021: CHF 393 million), thanks to a rebound in milling and strong sales in Electrical Discharging Machining (EDM). Europe and the Asia Pacific region (APAC) were key drivers of the growth. The first half of the year also saw the start of a recovery in the aerospace business. Despite substantial supply chain disruptions and raw materials scarcity, operating profit reached CHF 17.4 million (2021: CHF 9.1 million), leading to an EBIT margin of 4.0% (2021: 2.3%).

The division continues to be an industrial technology leader, pursuing its strategy to strengthen customer experience and service offerings. In mid-July, GF Machining Solutions acquired Italy-based Vam Control S.r.l. to reinforce its service offerings in Europe.

Strategy 2025 on track

The Strategy 2025 specifically addresses profitable growth, portfolio resilience and a "go for the full potential" spirit. With the ambition to become a sustainability and innovation leader, GF focuses on meeting the sustainability needs of its customers, providing them with superior customer value. GF is also focusing on a culture change to unleash the full potential of its most important asset, its people. The ambition is to create and foster a diverse and inclusive work environment, in which inspiration, collaboration and innovation empower employees to perform at their best.

Outlook for the full year 2022

Despite ongoing geopolitical and macroeconomic tensions, such as high inflation and disruptions in supply chains, GF's financial outlook for the full year 2022 remains unchanged. Assuming these challenges abate and no further unforeseen circumstances occur, GF expects that in 2022 further progress will be made towards the achievement of the Strategy 2025 targets in terms of both sales and profit.

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. For that reason, there might be limited comparability to similar figures presented by other companies. Additional information on these key figures can be found at www.georgfischer.com/en/investors/alternative-performance-measures.html.

(end)

| Emitter: |

Georg Fischer AG Amsler-Laffon-Strasse 9 8200 Schaffhausen Switzerland |

|

|---|---|---|

| Contact Person: | Beat Römer | |

| Phone: | +41 52 631 26 77 | |

| E-Mail: | beat.roemer@georgfischer.com | |

| Website: | www.georgfischer.com | |

| ISIN(s): | CH0001752309 (Share) | |

| Stock Exchange(s): | SIX Swiss Exchange |